All Categories

Featured

Table of Contents

Term life insurance policy might be much better than home mortgage life insurance policy as it can cover home mortgages and various other expenses. Contrast life insurance policy online in mins with Everyday Life Insurance Policy. Mortgage life insurance policy, additionally referred to as, mortgage protection insurance, is marketed to home owners as a means to settle their home loan in case of fatality.

Although it sounds excellent, it may be much better to obtain a term life policy with a big fatality advantage that can cover your home loan for your beneficiary. Home loan life insurance policy pays the rest of your mortgage if you pass away during your term. "Mortgage defense insurance coverage is a method to discuss insurance policy without mentioning dying," claims Mark Williams, Chief Executive Officer of Brokers International.

Yet unlike a typical term life insurance policy policy that has the same premium, it's rates and the survivor benefit generally decrease as your mortgage decreases. This insurance coverage is often puzzled with exclusive mortgage insurance coverage, but they are very different concepts. house insurance for home loan. If you have a mortgage and your deposit is much less than the average 20%, your loan provider will certainly need mortgage insurance policy to secure them in case you default on your mortgage repayments

Williams stated a person can name a partner as the beneficiary on a home loan security insurance coverage. The partner will get the cash and can choose whether to settle the mortgage or sell your house. If an individual has mortgage life insurance policy and a term life plan with the partner as the recipient on both, after that it can be a dual windfall.

Reducing term insurance policy is the more typical kind of mortgage life insurance coverage. With this plan, your insurance coverage premiums and protections lower as your home mortgage quantity decreases.

Mortgage And Protection

Home mortgage life insurance policy likewise needs no medical examinations or waiting durations. If you die with an exceptional home loan, home loan life insurance coverage pays the remainder of the lending straight to the loan provider. In turn, your liked ones do not need to deal with the financial problem of paying off the home mortgage alone and can concentrate on grieving your loss.

Your home mortgage life insurance policy plan is based upon your home loan amount, so the details will vary relying on the expense of your mortgage. Its rates reduce as your home loan lowers, but costs are normally a lot more expensive than a traditional term life policy - mortgage protection insurance sales. When selecting your fatality benefit quantity for term life insurance policy, the policy of thumb is to pick 10 times your annual revenue to cover the home mortgage, education and learning for dependents, and various other prices if you pass away

Your home mortgage life insurance coverage policy terminates when your home loan is settled. If you pay off your home mortgage prior to you die, you'll be left without a death benefitunless you have other life insurance policy. Unlike term life insurance policy, irreversible life insurance coverage offers long-lasting protection. It additionally includes a cash worth element, where a section of your premiums is conserved or spent, enhancing your plan's worth.

Homebuyer Protection Insurance

With an entire life plan, you pay a set costs for an ensured fatality benefit. In contrast, an universal life plan permits you to change when and how much you pay in costs, in turn readjusting your insurance coverage.

Home mortgage life insurance policy might be a good choice for homeowners with health and wellness problems, as this protection supplies instant coverage without the need for a clinical examination. However, standard life insurance might be the most effective choice for a lot of people as it can cover your mortgage and your other economic obligations. And also, it often tends to be more affordable.

With reducing term insurance coverage, your coverage decreases as your mortgage lowers. No, lenders do not call for home mortgage life insurance coverage.

Mortgage Protection Insurance Anz

One perk of home loan life insurance over a standard term plan is that it normally does not call for a clinical test - uob mortgage insurance. Ronda Lee is an insurance professional covering life, car, homeowners, and occupants insurance for customers.

ExperienceAlani is a former insurance coverage fellow on the Personal Financing Insider group. She's examined life insurance policy and pet insurance coverage companies and has actually composed numerous explainers on traveling insurance, debt, financial debt, and home insurance. She is passionate about debunking the complexities of insurance coverage and various other individual finance subjects to make sure that viewers have the information they require to make the most effective cash choices.

When you obtain a home loan to get your home, you will usually need to secure home mortgage protection insurance policy. This is a specific kind of life assurance that is gotten for the term of the home loan. It settles the home mortgage if you, or somebody you have the home loan with, dies.The loan provider is legitimately required to see to it that you have home mortgage security insurance prior to giving you a home loan.

Do You Need Life Insurance To Get A Mortgage

If you pass away without home loan insurance defense, there will certainly be no insurance coverage to pay off the home loan. This means that the joint proprietor or your beneficiaries will need to continue repaying the mortgage. The demand to take out home mortgage defense and the exceptions to this are set-out in Area 126 of the Non-mortgage Consumer Debt Act 1995.

You can obtain: Lowering term cover: The amount that this policy covers decreases as you pay off your home loan and the policy ends when the mortgage is paid off. Your costs does not change, although the level of cover decreases. This is the most common and most inexpensive form of mortgage security.

If you pass away before your mortgage is paid off, the insurance coverage business will certainly pay out the initial quantity you were insured for. This will certainly settle the mortgage and any kind of remaining balance will certainly most likely to your estate.: You can add significant ailment cover to your home mortgage insurance coverage plan. This means your mortgage will be settled if you are identified with and recover from a major ailment that is covered by your policy.

Life insurance policy cover: You can utilize an existing life insurance coverage policy as home loan defense insurance policy. Home loan payment defense insurance is a type of settlement protection insurance.

Total Mortgage Protection Plan

This kind of insurance is generally optional and will commonly cover settlements for twelve month - mortgage protection comparison. You must consult your home mortgage lender, insurance coverage broker or insurance coverage firm if you doubt about whether you have mortgage payment protection insurance policy. You need to also examine specifically what it covers and ensure that it matches your circumstance

Mortgage life insurance policy is less flexible than term or entire life coverage. With a home loan life insurance policy policy, your recipient is your home mortgage loan provider. This implies that the cash from the benefit payout goes directly to your mortgage loan provider. Your family never deals with the dollars that are paid and has no say in how that cash is made use of or dispersed.

Mortgage Life Insurance Quote Britain

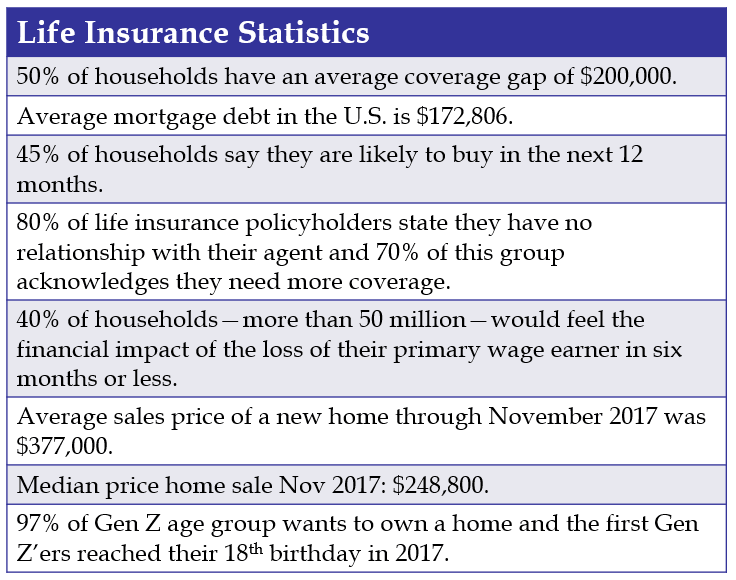

Obtaining a home loan is just one of the most significant duties that grownups encounter. Dropping behind on home loan settlements can result in paying more passion fees, late fees, foreclosure process and even shedding your home. Mortgage protection insurance policy (MPI) is one means to secure your family and financial investment in case the unimaginable happens.

It is specifically advantageous to people with pricey home loans that their dependents couldn't cover if they passed away. The vital distinction between mortgage security insurance coverage (MPI) and life insurance policy hinges on their coverage and flexibility. MPI is especially designed to settle your home mortgage balance directly to the lending institution if you pass away, while life insurance policy offers a broader survivor benefit that your beneficiaries can make use of for any kind of financial needs, such as home loan repayments, living expenditures, and financial debt.

Table of Contents

Latest Posts

Bank Infinity

Ibc Whole Life Insurance

Becoming Your Own Banker

More

Latest Posts

Bank Infinity

Ibc Whole Life Insurance

Becoming Your Own Banker